Digital Cash

Multi-currency stablecoins powering the Internet of Money and next-generation mobile financial services. Now available in the Telcoin Wallet.

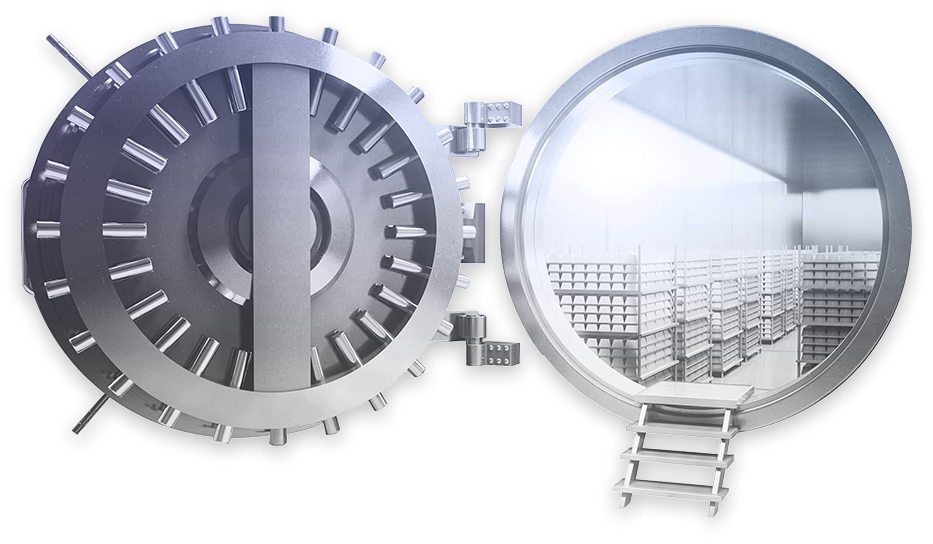

Telcoin Digital Asset Bank is the first true bridge between traditional finance and cryptocurrencies, with the first bank charter explicitly authorized to connect consumers with decentralized finance (DeFi). Its charter was granted in November 2025 by the Nebraska Department of Banking and Finance.

eUSD

The world's first regulated, bank-issued Digital Dollar

eUSD is the first regulated, bank-issued US dollar stablecoin. Connected to the backbone of traditional finance, eUSD will seamlessly integrate with existing global banking and payments infrastructure and provide a regulated alternative to existing stablecoins.

eEUR

Coming Soon

EU/EAA Digital Cash

Telcoin is preparing to release eEUR and other Digital Cash stablecoins for the European Economic Area under an e-Money Institution in compliance with European Union MiCA regulations.

Digital Cash is now live in the Telcoin Wallet

Currently on the Polygon network, with more networks coming soon

eAUD

Australian Dollar

0xaE90...FF67

0xaE90625e270da42152F0028d60EdD800dA72FF67

eCAD

Canadian Dollar

0x75Ba...520B

0x75Baaa7E53Ac90f3e0Eca1Ecc2991783b5A9520B

eCFA

African Franc

0x5370...778c

0x5370B325aef39E987406EB0aB1B86Bf04152778c

eGBP

Pound Sterling

0x6606...510a

0x660674AB7E524AEf817B6761fE48702F06D8510a

eHKD

Hong Kong Dollar

0xAE80...DDe2

0xAE804BBEA28AD87B200de16C8EAee42A0C22DDe2

eJPY

Japanese Yen

0x60AB...53De

0x60ABF4FEBE85294BC6e53BAb480F8c50AA1A53De

eMXN

Mexican Peso

0x6872...3c99

0x68727e573D21a49c767c3c86A92D9F24bd933c99

eNZD

New Zealand Dollar

0x654a...3171

0x654a2764616DD1291aC924eD83Cde44e3F1d3171

eSGD

Singapore Dollar

0xb33D...6f30

0xb33De3b5a9B765D469b83c826574bf34e9486f30

eSDR

Special Drawing Right

0x30d1...D483

0x30d148650C6B0fb0d14083d9aE9C339F2c11D483

eZAR

South African Rand

0x8D36...c29c

0x8D369A77048eeF9ACFb0cb1b770056A0212dc29c

Transforming banking and payments with Digital Cash

Digital Cash powers Telcoin's next-generation mobile financial services and is the backbone of the Internet of Money.

Cross-border payments

Remittances using Digital Cash aim to be the fastest and most affordable way to move money on the planet. Multi-currency support will enable native rails to local account numbers in countries around the world.

Direct merchant payments

The digital equivalent of handing a merchant a $20 dollar bill, Digital Cash direct merchant payments provide a more efficient alternative for casual payments at home and abroad.

Blockchain-based banking

Digital Cash-powered blockchain banking puts consumers in control, making one-click access to on-chain banking deposit, loan, insurance, and settlement products possible.

Transparent and secure

In addition to the trust and security that comes with Digital Cash issued by regulated financial institutions, Telcoin will also publish monthly attestations from an external auditor. These attestations will include transparent documentation of reserves versus Digital Cash in circulation.

The future of borderless money, powered by GSMA mobile networks

Telcoin is a GSMA Associate Member.

Mobile Financial Services 2.0

Telcoin empowers telecoms to run the settlement layer of self-custodial Digital Cash transactions, enabling direct merchant payments that will usher in the Internet of Money.

Treasury management

Borderless Digital Cash is ideal for treasury management, enabling telecom groups and other multinationals to easily manage subsidiaries, suppliers, and vendor payments on-chain.

Inter-carrier settlements

Putting inter-carrier settlements on the blockchain allows mobile networks to seamlessly settle roaming and interconnect payments with multi-currency Digital Cash at mid-market FX rates.

Digital Assets can be high-risk and subject to loss of principal. You should not transact in digital assets if you are not familiar with the risks of digital assets. Digital assets are not backed by any governmental insurance or guarantee.

See full Digital Cash terms and conditions here.